This research confronts the myth of active energy consumption. It suggests a new and collaborative path for district heating (DH) companies that want to remain relevant and competitive toward and beyond 2050. A study has been made to understand the future business conditions of DH and what these imply for the efficiency of current business models.

By Kristina Lygnerud, Senior Energy Expert at the Swedish Environment Research Institute, Adjunct Professor in Energy Sciences at Lund University, Chair of the European Knowledge Hub on District Heating and Cooling DHC

and Hanne Kortegaard Støchkel, Ph.D., Researcher, and Business Development Manager

Published in Hot Cool, edition no. 2/2023 | ISSN 0904 9681 |

1.1 To remain competitive in 2050, challenges need to be proactively managed

District Heating (DH) can play an important role in the European energy transition. This was pointed out as early as 2016 in the European Commission’s strategy for heating and cooling [1]. To remain competitive, DH companies must account for changes across the value chain- from heat supply (shifting from fossils to renewables and waste heat) to significant changes reflecting societal objectives 2040, 2050 even 2080. The many challenges ahead will likely necessitate a change in how many sectors, including DH, will have to revisit how business is conducted.

For a long time, hope was set on the active energy consumers – highly motivated and willing to act and overlook their own needs – to come and save the day. But human nature does not change much; instead, progress can be found when accepting and incorporating this in how DH companies develop their business to match new circumstances. This development is not a technical challenge; it requires opening up and reaching out to customers and society to co-create future solutions actively.

1.2 To study the future is difficult- a combination of methods was applied

Fact Box

In the project “The DH business model 2050 “, a group of mixed stakeholders has attempted to understand possible future customer values and business models for DH. The group consists of representatives from two cities (Albertslund in Denmark and Nice in France), one DH company (in Braunschweig, Germany), one industry association (Danish Board of District Heating), and two research organizations (University of Applied Sciences in Stuttgart and the Swedish Environmental Research Institute). IEA-DHC funded the research as an Annex XIII project, and the entire project report is publically available at https://www.iea-dhc.org/the-research/annexes/annex-xiii/annex-xiii-project-06.

To understand the future, different methods to collect data were combined. First, information about national, long-term objectives in the countries represented in the project group (Denmark, Sweden, Germany, and France), DH’s current and future role in these countries, and current and future competition to DH was collected (literature review).

Based on the findings, an interview guide was prepared to identify the current DH customer value and possible upgrades of it. Three groups of respondents were targeted: DH companies, waste heat owners (sometimes also a prosumer), and customers. Five interviews were targeted per group and country. Based on the literature review and interviews, future conditions under which DH companies will need to operate were identified (we call the boundary conditions).

With the boundary conditions as the point of departure, the project team engaged in identifying the value of the future DH customer offer. A tool to work on business model development called the value proposition canvas was applied (derived from the business model Canvas [2]. To use it is a process where the project team meets on several occasions to discuss different aspects of customer value.) Based on the joint discussions, two alternative customer value propositions for DH were identified. These were used to identify two possible business models of DH in 2050.

A study of the future is incomplete, and it is impossible to know if it will arrive at conclusions that will be realized in the upcoming years. Therefore, the project team engaged in several validation sessions with DH practitioners and mixed groups to gain feedback on identified results.

1.3 The boundary conditions of DH companies 2050

The countries studied in the project are at different levels of maturity where; both Denmark and Sweden are mature markets, Germany is a growing market, and France is a new market. As a result of the different maturity of DH in unalike markets, it is difficult to identify future DH boundary conditions that will apply simultaneously in various places.

The specified boundary conditions should be interpreted as indications of boundaries that DH companies must position themselves against in upcoming years. In some areas, the conditions will materialize sooner than in others.

Fact Box

- The heat demand is at similar levels as in 2020 on an overall EU level, and cooling demand is higher than in 2020

Assumption: adding the energy efficiency and the densification, the heat demand is assumed to be at similar levels as in 2020 (e.g., the energy density is considered to remain stable)- Heat supply is completely decarbonized, and it is standard to recover waste heat of both high and low temperature

Assumption: it is foreseen that the combustion of fossil fuels is no longer possible. Combined with increased circularity, the volumes of waste for incineration are lower. This means that other heat sources are needed where waste heat is important.- Heat supply is decentralized and combined with storage solutions

Assumption: the focus on large, centralized production and distribution has been replaced by an emphasis on using available heat sources (of varying sizes). Heat is provided on demand when the customer wants it. Therefore, the ability to store heat is increasingly essential.- Heat planning is mandatory at a municipal level

Assumption: it is standard for municipalities to have energy plans per sector where heating and cooling is one.- Circular economy and, as a result of circularity, coupled sectors

Assumption: it is standard to work with circular flows to reduce the waste of any resource. As a consequence of circularity being the dominant driver in the economy, sectors that combined can save resources are combined.- Investors in energy are diverse

Assumption: energy is a sector that has experienced a considerable transition period for several decades (2020ies-2030ies-2040ies). The investments have been forced to be sustainable (economic-environmental-social), which has become standard. The transition has fostered entrepreneurship and many possible investment projects attracting a diverse set of investors.- A high level of digitalization is standard

Assumption: Significant progress is expected. Using available data, algorithms, and integration across systems will support energy efficiency, improved flexibility and control, and stronger and automated consumer activation.

The identified boundary conditions are both a prediction and a desired future, but the actions DH companies, authorities, consumers, and others take will determine what will happen. This research project’s suggested approach to DH development can support and accelerate the road toward the future described by the boundary conditions, and it will help the DH sector to gain a more prominent and resilient position.

1.4 Future business model characteristics

Two value propositions were identified based on the literature review, interviews, and the value proposition process. The main difference in these is that they reflect different customer behavior. What we refer to as the “passive customer “value proposition reflects what most customers will demand: a cost-efficient, convenient energy service package that requires a low level of active involvement. The “active customer “value proposition differs and reflects customer involvement: the customers are involved in optimizing the heating system, with maximum transparency of their impact on the system.

As a reader, you might now wonder how the “passive customer “value proposition differs from the current DH customer value. The difference is that digital solutions have been fully developed and implemented. In 2050, we have solved many issues by automizing processes and systems. We have smart buildings and hardware supporting customers to adjust to efficient heating and cooling consumption patterns.

In 2022, the unique selling point of DH was the security of supply, carefreeness, and comfort at a reasonable cost. Another positive aspect is that the carbon footprint can be limited. In 2050, the unique selling point can be the carefree delivery: heating and cooling works (without any customer effort) at a high standard (the boundary conditions are taken for granted, so aspects like sustainable heat supply are standard). The cost of the energy service is also competitive with other alternatives.

The “passive customer “value is delivered to most customers as it is assumed that engagement in one’s energy supply will be limited to a minority of the customers: reflecting the customer behavior that dominates today. We do not identify that the future will be characterized by a large number of actively engaged energy customers, which is often supposed today. Indeed, the active customers or “energy citizens, “as they are often referred to, are assumed to remain a limited share of the customer population.

The “passive customer “value proposition can be delivered because it has become standard to engage in performance improvement activities with the few active customers that are present. The “active “customers that want to co-create and co-invest in new and more advanced solutions are at the core of DH company development and, most likely, the way to success.

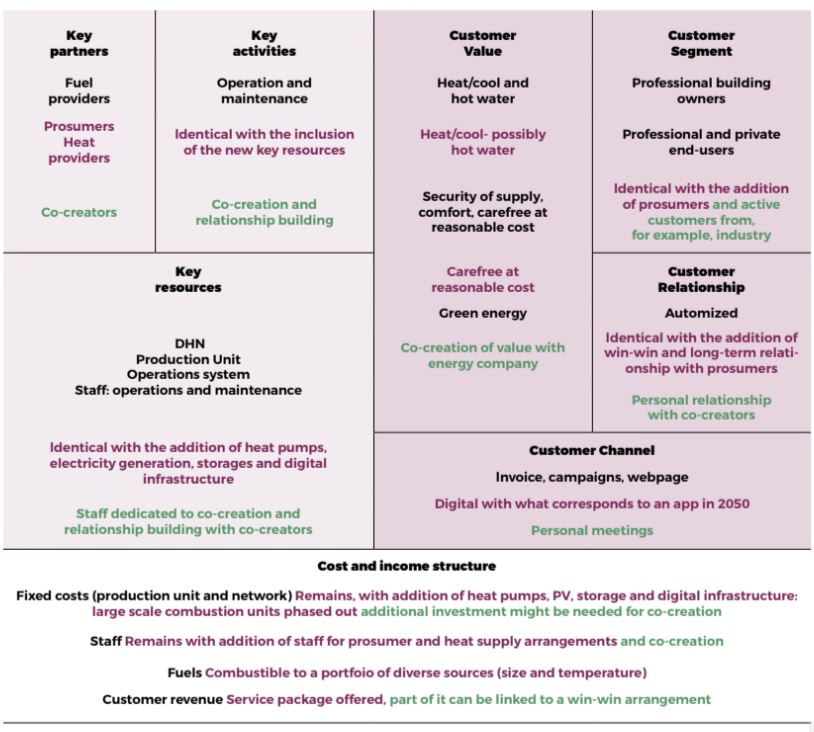

Regarding business model characteristics, both models are characterized by a customer value reflecting security of supply, carefree, and cost-efficient. In the “active “model, the dimension of “co-creation “of value is added. The primary customer segment will remain building owners with the addition of prosumers. For the “active “model, the active co-creators are added to the customer segment. The customer relationship will be standardized, and long-term, with prosumers added: for the “passive “model.

For the “active “model, the relationship will be close with the co-creators, and co-creation will occur. The “passive “model in the customer channel will reflect automized and digital communication (in an app). For the “active “model, a close-customer relationship is built. The new configuration of DH activity will necessitate changes to the fixed assets (removal of boilers, the inclusion of waste heat and heat pumps in the heat supply, storage units, installed digital infrastructure resorting to AI): applied for both models.

For the “active “model, co-creation is vital, leading to investments in new and often shared (between DH company and customer) assets. The key activities will shift to reflect the new essential assets. For the “active “model, co-creation and relationship-building are vital. Key partners are new heat providers (often prosumers) and, for the “active “model, the customers “co-creating “value.

The shift from a characteristic DH business model in 2022 to the “passive “model and the “active “model is illustrated below. The black text reflects the situation in 2022, the blue the “passive “model, and the green the “active “model.

Business Model Characteristics 2050

Figure 1 The black text reflects the situation in 2022, the purple the passive model and the green the active model

1.5 Key takeaways

DH companies can play an essential role in the European energy transition. To be successful, changes to the current way of conducting business are needed, and one critical component is digital smartness (of buildings and heating systems). To assume that the future will bring engaged energy citizens that support the development of new values is dangerous. Instead, DH companies should proactively engage with customers who want to collaborate and co-create new heat supplies.

For further information please contact: Kristina Lygnerud, kristina.lygnerud@ivl.se

References

Commission 2016: Commission, EU, An EU strategy on heating and cooling. Volume ID: COM (2016)51, EU Commission, Brussels, 2016

Ostewalder 2010: Ostewalder, A, Pigneur, Y, Business model generation, Wiley, New York, USA, 2010

Kristina Lygnerud

What makes this subject exciting to you?

The DH industry is facing several challenges, and significant change is ahead. There is much information on possible technical pathways, but how it is coupled to business model updates is rarely discussed. Flipping the coin and addressing the industry's challenges from a business perspective is very exciting.

Hanne Kortegaard Støchkel

What makes this subject exciting to you?

In my mind, the green transition is happening one decision at a time, and I like to find ways to prepare the road for better and quicker decisions. DH is a critical energy infrastructure that provides much more than "just" cheap, sustainable, comfortable, and reliable heating. I find the cross-section between developing DH and the benefits that DH can bring to other sectors very exciting.

What will your findings do for DH?

We hope to support strategy and business developers in DH companies across Europe. The next development steps for DH involve new stakeholders and more focus on co-creation, trust, and deeper collaborations. We hope our research will open some eyes to these new needs and opportunities.